Ontario communities experience a decline in homes under $500,000, MPAC data reveals

Year-over-year price increases are driving buyers to look at communities farther outside the GTHA

February 28, 2024

Ontario’s residential property landscape has continued to evolve over the last decade – communities with homes under $500,000 are becoming increasingly scarce. According to new data released by the Municipal Property Assessment Corporation (MPAC), the type of homes with a value less than $750,000 and where they can be found has also shifted.

As of December 2023, the median home value in Ontario was $765,000, with the median value in the Greater Toronto and Hamilton Area (GTHA) at $1,031,000. The median value represents the mid-point of the range, meaning half of properties have a value above, and half have a value below.

“Looking across the province, our data shows increases in home values across Ontario – even in smaller communities outside the GTHA,” says Greg Martino, Vice President and Chief Valuation and Standards Officer for MPAC.

“The reality is that current home prices are a reflection of various economic forces at play. Factors like supply and demand, increased construction and labour costs plus inflation are all part of what's driving today's house prices.”

LIMITED OPTIONS FOR FIRST-TIME BUYERS

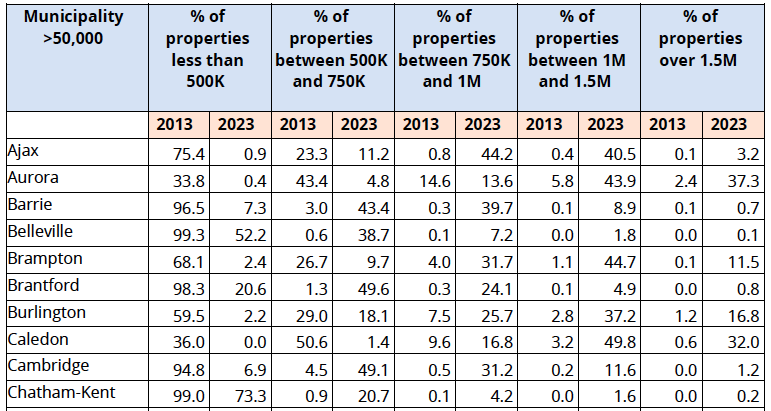

In 2013, 74 per cent of residential properties in Ontario had a home value estimate of less than $500,000, while 91 per cent of homes had a value of less than $750,000. Today, that number has dropped to just 19 per cent and 48 per cent, respectively.

To find properties for less than $500,000, one can look to cities such as Sudbury, Sault Ste. Marie, North Bay, Thunder Bay and Windsor. While homes under $750,000 can be found in cities such as Ottawa, London, Kitchener, Kingston, Barrie, and Peterborough.

CONDOMINIUM VALUES ON THE RISE IN GTHA AND TORONTO

For residential condominiums in the GTHA, 88 per cent of all units in 2013 were less than $500,000, with a median value of nearly $325,000. Today, a little more than 11 per cent of condos in the GTHA are priced in this range, and the median condominium value is more than $645,000.

In 2013, almost 85 per cent of condominiums in the city of Toronto had a value of less than $500,000. Today, that number has dropped to less than 11 per cent, with the majority of condominiums falling between $500,000 and $750,000.

Generally considered a viable option for first-time buyers in the GTHA, buyers looking to enter the market may need to look beyond the GTHA for a condominium priced at less than $500,000.

DETACHED, SEMI-DETACHED & TOWNHOME PRICES INCREASING AT UNPRECEDENTED RATES

Semi-detached and townhomes have also appreciated in value during this period. In 2013, 94 per cent of semi-detached and 97 per cent of townhomes were priced at $750,000 or less. Ten years later, that number has dropped to only 33 per cent of semi-detached homes and 46 per cent of townhomes, a decrease of 61 per cent and 51 per cent respectively.

When looking at a value of $500,000 or less, the inventory drops to just 13 per cent for semi-detached and four per cent for townhomes.

In 2013, the median home value for a detached home in the province was nearly $378,000. Today, that number has increased by 128% to over $862,000.

Forty-one per cent of detached homes across the province are estimated to be worth more than $1 million. This is in contrast to 2013, when the inventory of homes at this price point was only six per cent. In the GTHA, more specifically, more than 78 per cent of detached homes are estimated to be worth more than $1 million, compared to almost 12 per cent a decade ago.

For more information, view our property insights (housing inventory) map.

QUICK FACTS

To view the Distribution of Residential Property Inventory for more than 40 Municipalities, click here.

About MPAC

MPAC is an independent, not-for-profit corporation funded by all Ontario municipalities, accountable to the Province, municipalities and property taxpayers through its 13-member Board of Directors.

Our role is to accurately assess and classify all properties in Ontario in compliance with the Assessment Act and regulations set by the Government of Ontario. We are the largest assessment jurisdiction in North America, maintaining an inventory of more than 5.6 million properties with an estimated total value of more than $3.1 trillion.