Qualifying for Farm Tax Incentive Programs

As the owner of a farm property, you may be eligible for a reduction in the amount of property taxes you pay through one of these incentive programs.

Farm property class tax rate program

If you own a farm and you believe it could qualify for the Farm Property Class Tax Rate Program (also known as the Farm Tax Program), you must submit an application to Agricorp. For more information about the program and the eligibility requirements, please visit agricorp.com.

If you qualify, we will place your farmland and associated outbuildings in the farm property tax class.

Your municipality applies the farm property tax class rate to your property tax bill and you will be taxed up to 25 per cent of your municipality's residential property tax rate.

Small-scale on-farm business subclasses

Effective January 2022, the Government of Ontario introduced a second optional subclass for both the industrial and commercial subclasses to provide further support to small-scale on-farm businesses. The new legislation allows municipalities to increase the threshold of eligible assessment to which the reduced tax rate applies from $50,000 to $100,000.

To be eligible for the small-scale on-farm business subclass:

- Your property must be assessed as farmland and placed in the Farm Property Tax Class Rate Program by Agricorp.

- The council of a single or upper-tier municipality must pass a bylaw for both subclasses or a bylaw for the industrial subclass alone. The commercial subclass is only available if council opts for the industrial subclass.

- At least 51 per cent of your facility must be used to sell, process or manufacture goods produced on your farmland.

- It does not apply to properties where the total assessed value of the land used for the on-farm business is $1,000,000 or more.

To learn more, please read our FAQ.

Farm forestry exemption (FFE)

What is the initiative?

To protect wooded areas, farmers with farm property or farm property holdings with wooded areas may qualify for the Farm Forestry Exemption (FFE). The tax exemption applies to one acre of forested land for every 10 acres of farmland.

To prescribe a higher number of acres, O. Reg. 282/98 is amended to include Section 23.1.2, which states:

- For the purposes of paragraph 19 of subsection 3 (1) of the Act, 30 acres is prescribed as the higher number of acres for the 2023 taxation year and subsequent taxation years.

- Assessment Act and O. Reg. 282/98 are amended for FFE, effective January 1, 2023.

Property eligibility

To be eligible for the farm forestry tax exemption your property must be valued as farmland and have some forested or woodland areas.

MPAC will automatically apply the exemption if your property qualifies.

How FFE is calculated

It involves calculations based on a ratio of the owner’s entire land holdings to the forested or woodland parts within one municipality. Limited to one acre of land used for forestry purposes for every 10 acres of the farm.

No more than 30 acres are exempt per owner per municipality or non-municipal territory.

Examples

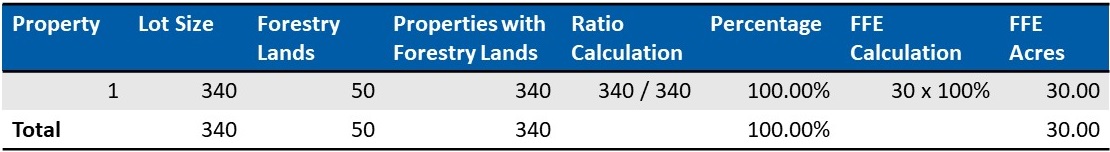

Example 1

Owner has one property, 340 acres total holding. This parcel has forested lands. The total forestry lands equal 50 acres, only 30 acres are eligible.

Example 2

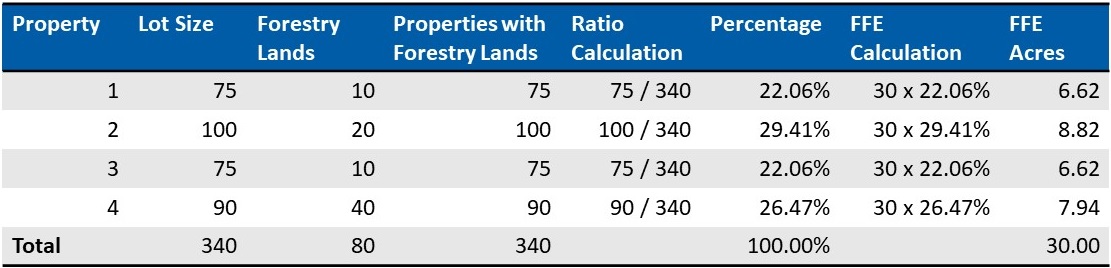

Owner has four properties, 340 acres total holdings. All parcels have forested lands. Although the total forestry lands equal 80 acres, only 30 acres are eligible.

Example 3

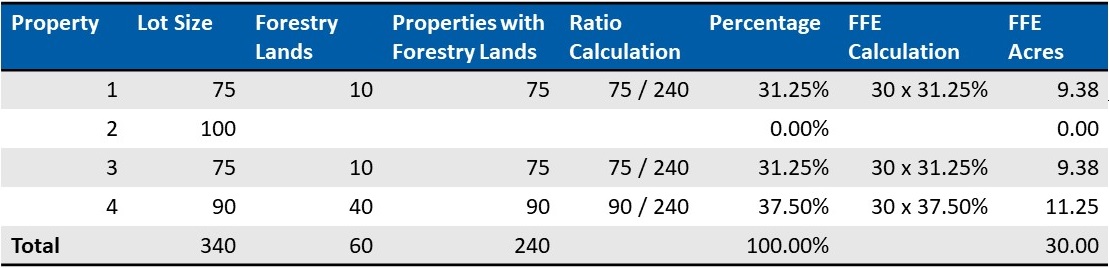

Owner has four properties, 340 acres total holdings. Only three of the four parcels have forested lands. Parcel #2 does not have any forestry lands; therefore, is not allocated any FFE lands. Although the total forestry lands equal 60 acres, only 30 acres are eligible.

Example 4

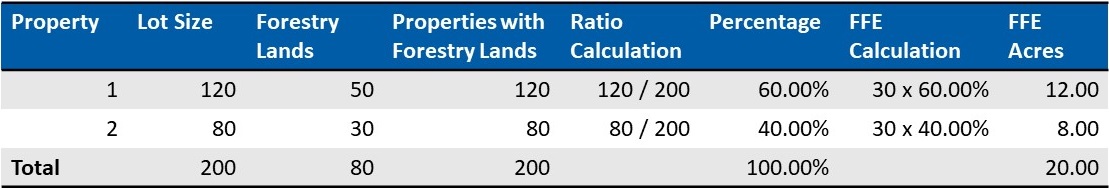

Owner has two properties, 200 acres total holdings. Both parcels have forested lands. Although the total forestry lands equal 80 acres, only 20 acres are eligible. (Legislation allows for one acre for every 10 acres of farmland; this parcel is 200 acres, therefore 10 per cent of 200 acres = 20 acres).

How FFE is identified

The value attributed to the Farm Forestry Exemption eligible acreage will be shown as an exempt portion of your total assessed value.

To learn more, please read our FAQ (PDF).