How Phase In works

When your assessed property value is higher than it was in the previous valuation, we phase that new value in gradually over four years in order to provide you an additional level of property tax stability and predictability. On the other hand, if your assessed value is lower than it was previously, we'll apply that lower valuation immediately.

Video: Understanding Phase in video

A property value increase is phased in

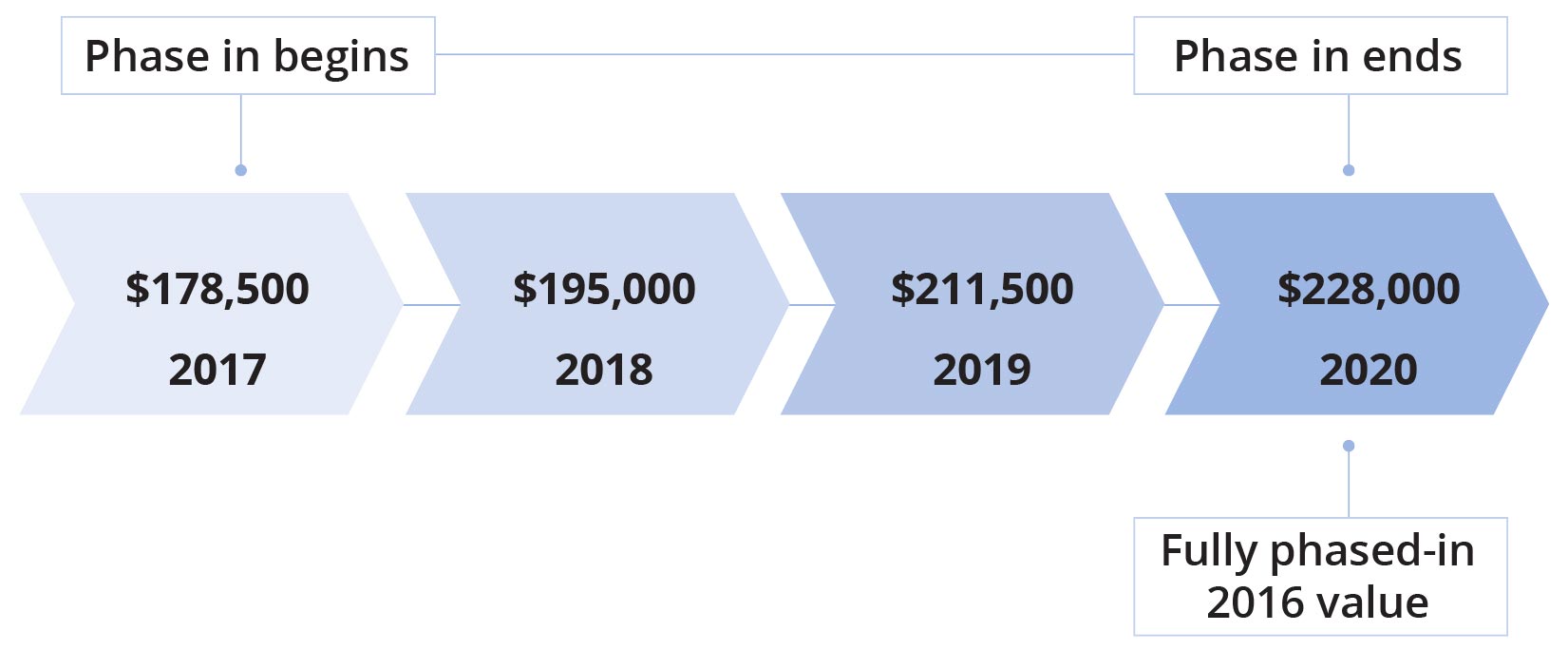

Let's say that your property was valued at $228,000 on January 1, 2016, the valuation date. The last notice you received from us was for the previous valuation date, January 1, 2012, and we valued your property at $162,000. Therefore, your property's value increased by $66,000 over the four years in between.

We will not apply that $66,000 market increase immediately, but will phase it in gradually over four years.

- The difference between the 2012 value and 2016 value is divided by four to determine the phase in value for each tax year.

- $228,000 - $162,000 = $66,000

- $66,000 / 4 years = $16,500

This means that from 2017 through to 2020, the value will increase by $16,500 each year. This is the value that will be used each year by your municipality to calculate your property taxes, provided no changes are made to your property.

Phased in valuation by year, used by your municipality to calculate your property taxes:

- 2017: $162,000 + $16,500 = $178,500

- 2018: $178,500 + $16,500 = $195,000

- 2019: $195,000 + $16,500 = $211,500

- 2020: $211,500 + $16,500 = $228,000

A property value decrease is applied immediately

If your property was valued at $137,000 on January 1, 2016, but was valued at $162,000 on January 1, 2012 your property decreased by $25,000 between the two valuations. The new valuation will be applied immediately and is the value that will be used each year by your municipality to calculate your property taxes, provided no changes are made to your property.

Valuation each year, used by your municipality to calculate your property taxes:

- 2017: $137,000

- 2018: $137,000

- 2019: $137,000

- 2020: $137,000

No change in value

If there is no change in your property’s value, the phase in values will remain the same for all four years of the assessment cycle, provided there are not changes to your property.