Let's unpack your property assessment.

Homeownership brings unique experiences, like navigating property assessment and taxation.

If you’re not sure how your property assessment relates to your taxes, we want to help. Understanding your property assessment can assist you in making informed decisions about your home.

Expand each section below for resources and answers.

Homeowners FAQ

What is MPAC?

We’re Ontario’s property market experts. We assess the value of every property in Ontario.

Our assessors, based across the province, live and work in your community. Their local insights help inform our property data, which is used by municipalities to set property taxes.

We also help property owners, governments, and businesses learn about their local property market.

I received a Property Assessment Notice (PAN) from MPAC. Is this a tax bill?

No. Your Property Assessment Notice from MPAC isn’t a tax bill. It’s a notice that MPAC has assessed the value of your home.

Your notice contains your property value and its tax classification.

Your municipality will use the information in your notice to calculate your property taxes.

Why did I receive a Property Assessment Notice (PAN)?

MPAC conducts province-wide reassessments, when we update the assessed value of every property.

After each reassessment, every property owner in Ontario receives a Property Assessment Notice from MPAC.

Every November, MPAC also sends these same notices to property owners who either bought their home within the last year or updated their property.

As a new homeowner, you would have received your first notice this November.

I recently received a Property Assessment Change Notice (PACN). I also received a Property Assessment Notice (PAN). What’s the difference? Why did I get two notices?

If your home was recently built or if you’ve completed renovations, you’ll receive a Property Assessment Change Notice (PACN).

MPAC sends these notices each month between April and November. You may receive one for these reasons:

- There was a change to your property such as an addition, new construction or renovation.

- We assessed a structure like a pool, or a garage, for the first time.

- There was a change to your property’s classification. For example, if you built a new structure on your property to run a business, that new structure may be classified as commercial.

- Your property, or part of it, no longer qualifies for a tax incentive for farmland, conservation land or managed forests.

- Your property, or part of it, no longer qualifies as tax exempt. For example, you converted an old church into your dream home.

Your Property Assessment Change Notice (PACN) includes the assessed value and classification of any updates made to your property.

This information enables your municipality to ensure your future tax bills will reflect the value of your home in its current state and condition.

In November, you’ll also receive a new Property Assessment Notice (PAN). This notice type will list any changes made to our records, including the updated value of your property.

For example, let’s say you bought a home built in the 1990s, in its original state. You decided to take out a building permit and complete renovations that will bring the interior up to date. Once your renovations are done, you may receive a Property Assessment Change Notice (PACN) to reflect the value of your renovations.

Then, in November, MPAC will send you a Property Assessment Notice with the updated assessed value of your entire property, and any other changes we may have noted on file.

Other updates would include the change in ownership that occurred when you purchased your home, in addition to any other updates you may have made, like a change in school support designation.

Learn about the different types of notices you may receive from MPAC here.

Here are a few tips on how to read your Notice:

I purchased my home earlier this year. I haven’t received a notice. When can I expect it?

If you purchased your home earlier in the year, it’s possible to receive a tax bill before you receive your first notice from MPAC.

MPAC mails Property Assessment Notices in November. You’ll receive your notice this year if:

- You purchased your home in November or December of last year.

- Or, between January and the end of October of the current tax year.

November has come and gone. I still haven’t received a notice. What’s going on?

If you haven’t received your Property Assessment Notice, it’s possible we have the wrong mailing address on file.

We want to make sure you’re kept in the loop about any updates or changes that might affect your property's assessment. So, if you aren’t getting your notices, please reach out to our friendly Customer Contact Centre at 1-866-296-6722 between 8 a.m. and 5 p.m. Monday to Friday to confirm your address.

This simple step can help you avoid any potential delays or missed deadlines, such as filing a Request for Reconsideration (RfR). Having access to your files also allows you to verify our information is correct, giving you peace of mind.

You can also create an MPAC AboutMyProperty account to easily update your mailing address online. It’s a quick process that can save you time, money, and unnecessary hassle in the future. For more information about this option, check out the next question!

Want to learn more? Visit our Changing Your Mailing Address page.

I want to review my property assessment information. I don’t have a Property Assessment Notice (PAN). What can I do?

If you haven’t received your first notice yet, or even if you did receive one, but have since lost it, let us know.

Our Customer Contact Centre can help registered owners create an MPAC AboutMyPropertyTM account.

As a registered MPAC AboutMyProperty user, you'll be able to:

- View and manage your property details online, including updating your mailing address and tracking your request status.

- Review your property assessment information (even if you’ve lost your notice).

- Learn about how we assessed your property and compare it to 100 others in your neighbourhood.

- Update your school support.

- File a Request for Reconsideration (RfR).

Contact us Monday to Friday, from 8 a.m. to 5 p.m. Call us at 1 866 296-6722.

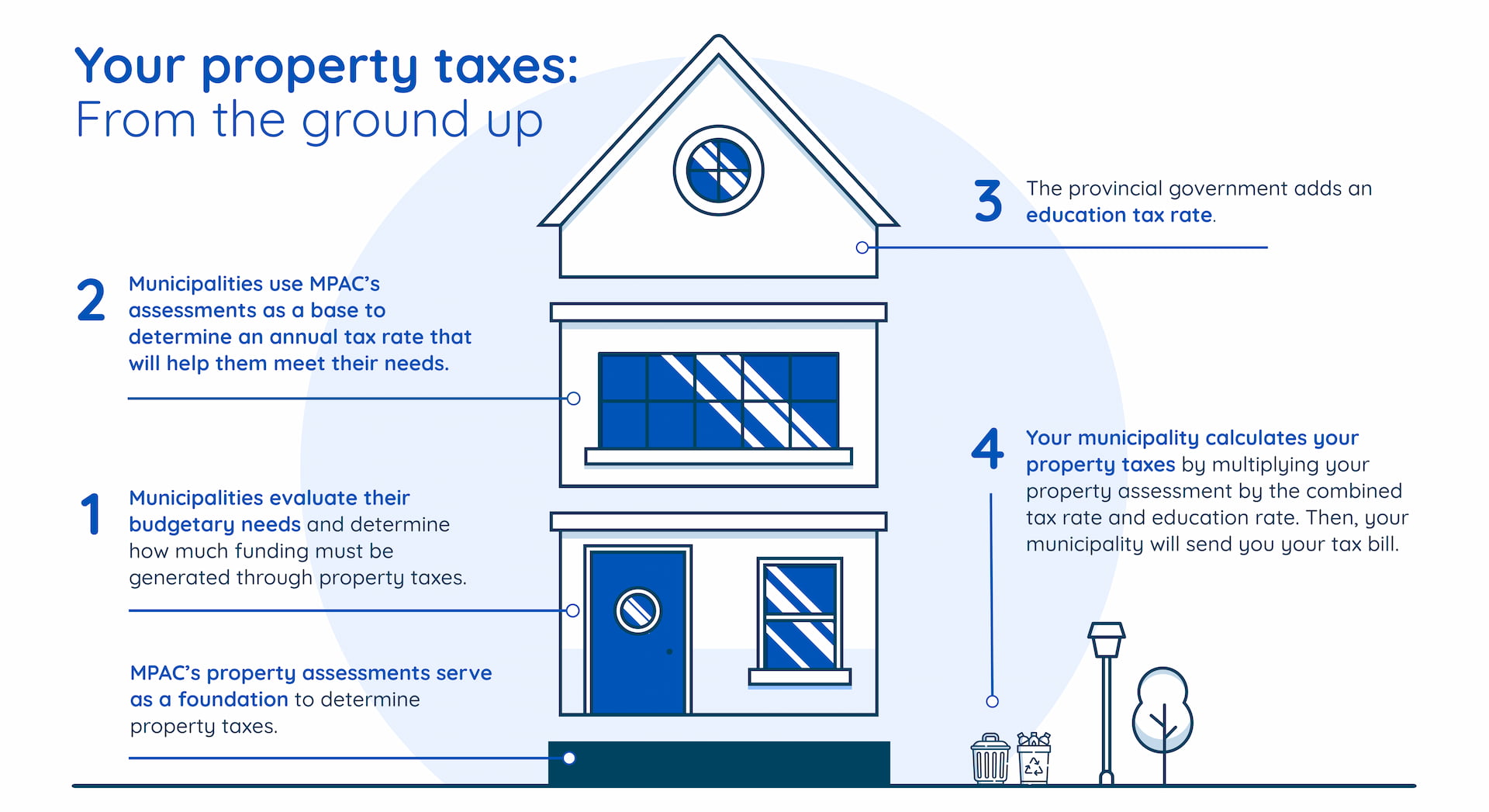

Who sets my property taxes?

In Ontario, municipalities set property taxes. MPAC determines your property value and classification.

Municipalities use MPAC’s property assessments as a foundation to determine property taxes:

To calculate your property taxes, municipalities use the following equation:

Learn more about how your property taxes are calculated:

What is a valuation date?

Properties in Ontario are valued as if they all sold on the same day.

This day is called the valuation date.

The Provincial Government sets the valuation date to help ensure property assessments are fair.

Why is the valuation date January 1, 2016?

Usually, the Ontario Government sets a new valuation date every four years. MPAC then reassesses every property in Ontario based on the new date.

The Ontario Government postponed the 2020 reassessment because of the COVID-19 pandemic, so the last province-wide reassessment happened in 2016.

As a result, MPAC is still using January 1, 2016, as the valuation date.

If my home was built after January 1, 2016, how can my property's value be based off this date?

Our job is to find out what your home would have sold for, in its current state and condition, on the valuation date set by the province.

For example, let’s say you recently bought a home built in 2022. We’re assessing your home as it is, but as if it existed on January 1, 2016 – even if your home wasn’t built yet.

Think of it as ‘this' home selling on ‘that’ date.

Why is there a 2012 value on my notice?

If your home were built today, we would create a starting value based on the previous assessment cycle’s valuation date to help determine your property's starting value. This is why you may notice a January 1, 2012, property value on your Property Assessment Notice, too.

Note: It’s important to remember the January 1, 2012, assessed value is only used to help calculate your starting value. It has no bearing on your property’s January 1, 2016, assessed value.

Why is my assessed value different from the amount I bought my home for?

Often, the sale price of a property won’t be the same as its assessed value.

To help ensure your property assessment is fair, MPAC bases property assessments on market value instead of sale prices.

The sale price of a property is the final dollar amount negotiated and agreed upon between a buyer and a seller.

Assessed value, however, is determined through sales analysis.

We determine assessed value by looking at properties with similar characteristics and evaluating the following criteria:

- What they likely would have sold for on the open market.

- What they would have sold for on the same date.

- What they would have sold for in a specific area.

Example: Let’s say you just received an offer for your dream job in another city. You need to move as soon as possible, and you’re willing to take the first offer on the table. A neighbour down the road, who owns an identical model, puts their home on the market, too. Your neighbour isn’t in a hurry to sell. They may receive multiple offers and may sell their home for much more than you.

It wouldn’t be fair for the new owners of these two identical properties to be assessed and taxed differently, simply because your neighbour had more time to sell. Valuing these two properties as if they sold on the same day would protect the new property owners from inequities.

Tip: Visit MPAC AboutMyProperty to compare your property to up to 100 others in your neighbourhood. This will help you build an understanding of market value in your area.

How are sales used to determine assessments?

Through market sales analysis, MPAC captures market changes and determine the factors contributing to them. Factors we may consider include:

- How properties are advertised and purchased.

- The relationship between buyers and sellers (Examples: Inheritances from family members, sales between friends, business deals).

- Circumstances that may have affected the sale price. (Estate sale, forced sale, etc.)

- Original asking prices.

- How long properties were listed before they sold.

Once we have gathered this information, we apply these factors to your valuation and ‘time adjust’ sales to the valuation date.

Why do we time-adjust sales?

Very few properties sell right on the valuation date. Sales occurring before or after the valuation date may not reflect exact market conditions.

Adjusting sales to the valuation date protects homeowners from market variables and ensures your property assessment is fair.

In the market to learn more? Check out the video below:

An MPAC representative came to my home. Why?

MPAC representatives will come to your home for only one reason. We need to make sure we have the correct information to calculate your home’s value.

While Section 10 of the Assessment Act grants MPAC the right to access your property, we want to make sure you feel comfortable when our representatives get there.

Before we visit, we’ll send a letter to let you know we’ll be coming soon. When our property inspectors arrive, they’ll also be easily identifiable. Ask our representatives to present their blue MPAC lanyard and official MPAC ID cards.

If we come at a bad time, we can also connect by phone. Your property inspector will leave a door hanger with contact information. Please call us back. On-site inspections, paired with your insight, are the key to ensuring your information is accurate.

What type of information is this property inspector looking for?

There are over 200 variables MPAC considers when determining your home's value.

To help determine the value of your home, we may ask you questions, like:

- Do you have a finished basement?

- Are your countertops granite or laminate?

- What kind of heating system you have?

- Are you on a septic system or well?

- How many fireplaces do you have?

- Do you have standard ceilings? Are they vaulted? Coffered?

By asking these questions, we are making sure your property will be assessed equitably to others with similar features.

What happens during a property inspection? An MPAC property market expert explains:

MPAC has a few data tools that could help you with your property search. Prospective homebuyers can check out our Housing Inventory Map to help inform future investments. This tool lets you explore communities across Ontario to find the best market for your budget.

You can also use our Property Pulse Dashboard in MPAC AboutMyProperty if you’re a registered user. Updated monthly, the dashboard illustrates evolving trends in the housing market.

The Property Pulse Dashboard lets you review real-time residential sales data by municipality and property type. You can also use our “compare” feature to analyze sales information from five municipalities. Customize your search to find what you need, with criteria like sales year/month, year built, and square footage.

You can learn more about how we’re making it easier for Ontarians to use MPAC data here.

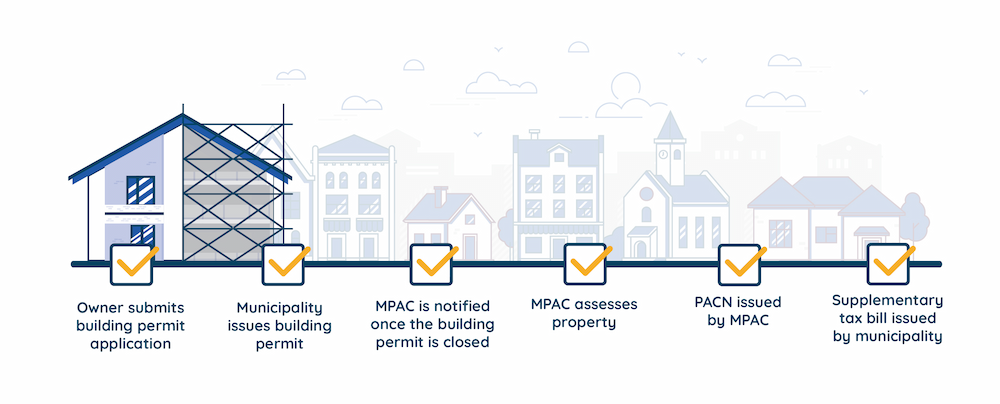

How does the building permit process work? How will MPAC find out if I’ve updated my property?

When you construct, renovate, or demolish a building in Ontario, you need a building permit.

You can submit a building permit application to your municipality. The municipality will review your application and issue a building permit.

If you update your property after getting a building permit, your municipality will notify MPAC.

When we review your building permit, one of our local experts may contact you to ask some questions. We may also visit you for an on-site property inspection.

MPAC will update your property value to reflect the work completed. We will then notify both you and your municipality. You will receive a Property Assessment Change Notice (PACN) in the mail.

Then, your municipality will issue a supplementary/omitted tax bill. This new tax bill will reflect the change in assessment.

Here’s what the process looks like:

I purchased a newly built home. When and how will MPAC assess my property?

You can expect MPAC to assess your home within one year of occupancy.

When your home is complete, one of our local experts will visit you. We come to ensure we have the most up-to-date and accurate information about your property.

To assess your home, we will look at land title documents, building permits and key factors of your home’s value.

Once we assess your new home, both you and your municipality will be notified.

Then, you'll receive a Property Assessment Change Notice (PACN). This notice type will outline your property details and the assessed value of your new home, in its current state and condition, as of January 1, 2016.

Remember, we assess your newly built home as it is, but as if it were built on January 2016 (even if it didn't actually exist then).

Once notified, your municipality will also issue a supplementary/omitted tax bill. This new tax bill will reflect the change in assessment for each affected tax year.

At the end of the year, you'll also receive a Property Assessment Notice (PAN) to summarize all changes made to your property.

How will a renovation or an addition affect my taxes?

We'll notify your municipality of the change in value, and they'll issue a supplementary tax bill. Check your municipality’s billing schedule to see when you'll receive yours.

Supplementary taxes are set by multiplying the supplementary assessment by the tax rate. The amount will get prorated based on the number of days the building has been complete or occupied.

What is school support?

School support designation helps property owners and tenants choose which school board to support in a school board election.

In Ontario, MPAC must collect information about which school board you support. We provide this data to municipalities and school boards for planning purposes.

When you purchase a property in Ontario, your school support defaults to the English-Public school board. However, there are five different school support designations you can support:

- English-Public

- French-Public

- English-Separate (Catholic)

- French-Separate (Catholic)

- Protestant-Separate (Penetanguishene only)

How can I change my school support designation?

We want to ensure you can support the school board that best aligns with your beliefs, values, lifestyle and culture. To make changes, you can update your school support here.

You may change your school support designation if you meet any of the following criteria:

Catholic school board:

- You, or your joint owner/tenant, must be Roman Catholic.

French-language school board:

- French is your first language, and you still understand.

- You attended a French elementary school in Canada.

- Or your child(ren) attends a French-language elementary or secondary school in Canada.

French-Catholic school board:

- You, or your joint owner/tenant, must be Roman Catholic, and;

- French is your first language, and you still understand.

- You attended a French elementary school in Canada.

- Or your child(ren) attends a French-language elementary or secondary school in Canada.

What is the education tax rate in Ontario?

By purchasing a property in Ontario, you’re helping fund elementary and secondary schools in Ontario through the education tax component. Regardless of whether you have school-aged children, your contribution supports education in your community.

What can I do if I disagree with my assessment?

If MPAC has incorrect information, or if you disagree with your assessment, your first stop should be MPAC AboutMyProperty.

On MPAC AboutMyProperty, you can compare your assessed value to 100 properties near you. Doing this will help you create a baseline to determine if your assessment is like others in your neighbourhood.

If, after comparing your property, you think your assessment is inaccurate, you can file a Request for Reconsideration (RfR). We will work with you directly to review your property information. The entire process is free.

The easiest way to file a Request for Reconsideration (RfR) is through MPAC AboutMyProperty. The deadline to submit yours will be listed on your Notice and directly within MPAC AboutMyProperty, too.

If you aren’t satisfied with the results of your Request for Reconsideration (RfR), you can also file an appeal with the Assessment Review Board (ARB).

Want to learn more about your assessment? Unlock MPAC AboutMyPropertyTM!

Learning about your property assessment is easier than ever. Through MPAC’s online portal, MPAC AboutMyProperty, you can:

- View and manage your property details online, including updating your mailing address and tracking your request status.

- Review your property assessment information (even if you’ve lost your PAN).

- Learn about how we assessed your property and compare it to 100 others in your neighbourhood.

- Update your school support.

- File a Request for Reconsideration (It’s free!).

Your Property Assessment Notice (PAN) holds the key.

Use your 19-digit roll number and the access key listed on your notice to log in to MPAC AboutMyProperty.

Haven’t received a Property Assessment Notice (PAN) yet? Lost it?

Don’t worry. We can help.

Contact us at 1 866 296-6722

We’re available Monday to Friday, from 8 a.m. to 5 p.m.