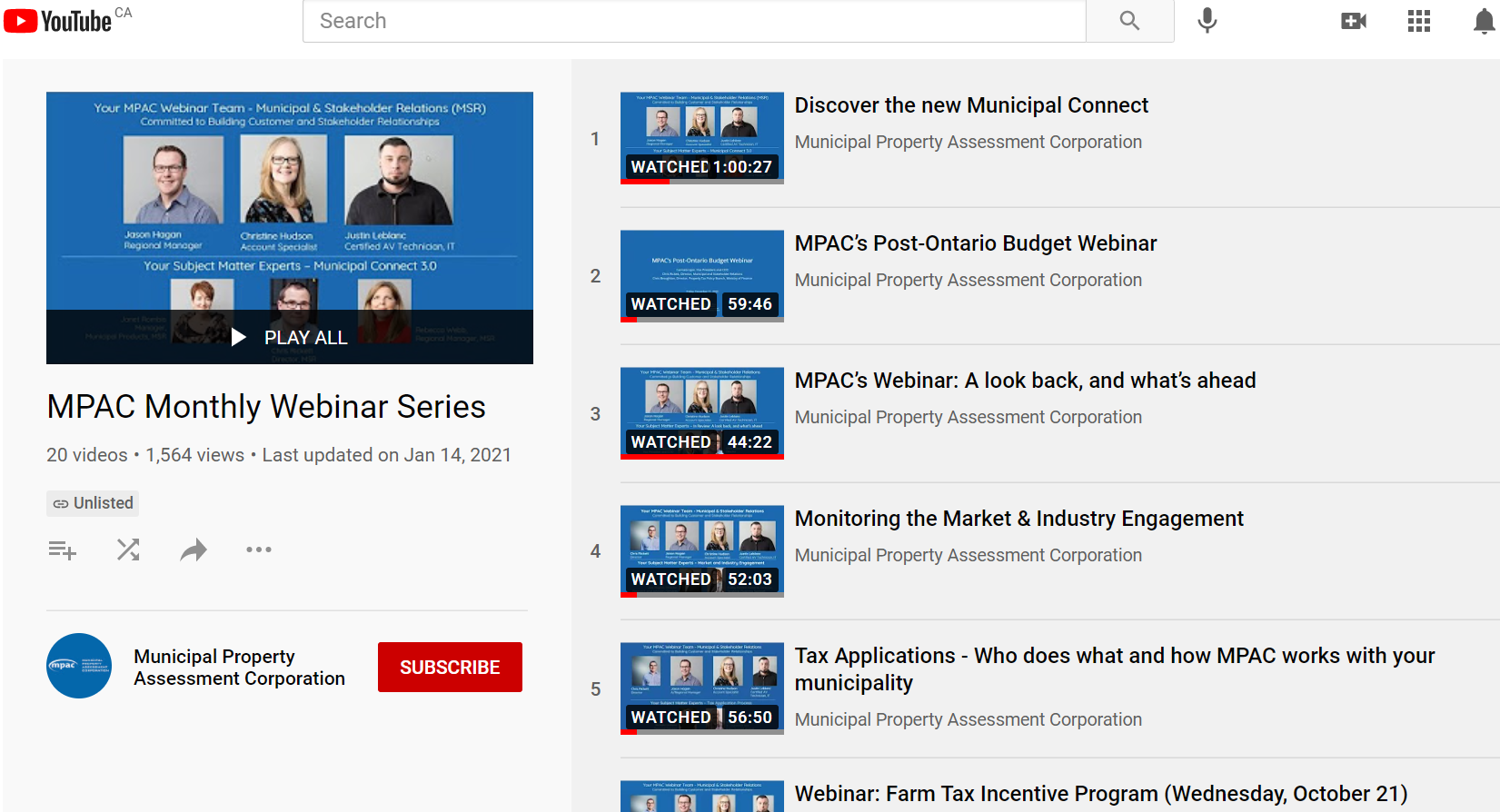

Monthly municipal webinars

2021 Webinar schedule

| Date | Topic* |

|---|---|

| January 14 | Discover the new Municipal Connect |

| February 4 | MPAC's Working-From-Home: IT Best-Practices Learned from COVID-19 |

| March 4 | |

| April 8 | |

| May 6 |

MPAC Central Processing Facility - Update on Addressing, Severances and Consolidations |

| June 3 | |

| August 30 | How the pandemic is impacting property sectors in Ontario |

| September 24 | |

| October 7 |

Introduction: MPAC’s Municipal Analysis Tool |

| October 28 |

Overview of 2022 Enumeration Process |

| November 4 |

Appeals Update and Overview of Annotated Assessment Act |

| December 2 |

Annual MPAC - Municipal update |

*Topics are subject to change.

Past webinar recordings

Register now

Small Business Property Tax Subclass Policy Paper

Join MPAC for an overview of the soon-to-be released Ontario Small Business Property Tax Subclass Policy Paper.

Developed by MPAC in partnership with its municipal and industry partners, the policy paper provides an overview of how the new Small Business Property Tax Subclass can be leveraged to achieve local economic development and planning goals, as well as pathways municipalities can consider when looking to consider or implement this new optional property tax subclass.

The session will be delivered by MPAC’s subject matter experts, Brian Gordon and Michelle Lindquist, Regional Managers, Municipal and Stakeholder Relations, and will also include a demonstration of a new geospatial tool by Jake Lefebvre, MPAC Account Manager, that will be available to assist municipalities with analysis of potential tax policy scenarios starting in 2022 in the New Municipal Connect.